are car loan interest payments tax deductible

Interest paid on personal loans is not tax deductible. Are car loan interest payments tax deductible.

Any interest you earn on that money while you wait is taxable.

. May 10 2018. The interest payments made on certain loan repayments can be claimed as a tax deduction on the borrowers federal income. 1 Car Is Considered A Luxury Product In India And In Fact Attracts The Highest Goods And Services Tax Gst Rate Of 28 Currently.

If you drove 1000 miles in 2021 strictly for business the tax deduction would equal 560. Interest on qualified student loans is tax-deductible. Even though interest on a car loan appears in Section 163 of the tax code as a deductible expense you cannot receive tax-free reimbursement from the S-Corp for this.

But there is one exception to this rule. In most cases interest is a deductible expense on your business tax return and these expenses can include interest on loans mortgages and. A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

You can only use a loan as tax-deductible if the vehicle is for a business. Typically you can only deduct car payments from your tax return if you use the car for business uses. How Much Of Your Car.

Typically deducting car loan interest is not allowed. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest. Apr 15 2022 5 min read.

As such the shield is 8000000 x 10 x 35 280000. The loan itself isnt. This is true for bank and credit union loans car loans credit card debt lines of.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as. If you borrow to buy a car for personal use or to cover other personal. The same is true if you take out the loan to purchase stock or another investment vehicle.

However for commercial car vehicle and. This is equivalent to the. Business Loans In most cases the interest you pay on your business loan is tax deductible.

Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest. Usually the answer is no but there are exceptions.

2 Furthermore You Wont Be. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Unlike the actual expenses method you cant designate other vehicle expenses as a.

As a result you cant benefit from any deductions for vehicles you use solely. Tax-deductible interest payments According to the IRS only a few categories of interest payments are tax-deductible. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return.

Are car loan interest payments tax deductible. What interest can I deduct on my taxes. Normally the interest paid on personal loans credit cards or car loans are in most cases not tax-deductible.

Mortgage Interest Deduction A Guide Rocket Mortgage

Don T Get Taken For A Ride Protect Yourself From An Auto Loan You Can T Afford Consumer Financial Protection Bureau

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Free 9 Sample Car Loan Calculators In Excel

:max_bytes(150000):strip_icc()/loan_shutterstock_573964660-5bfc316e46e0fb0083c18cfd.jpg)

Are Personal Loans Tax Deductible

What To Do When You Can T Afford Car Payments

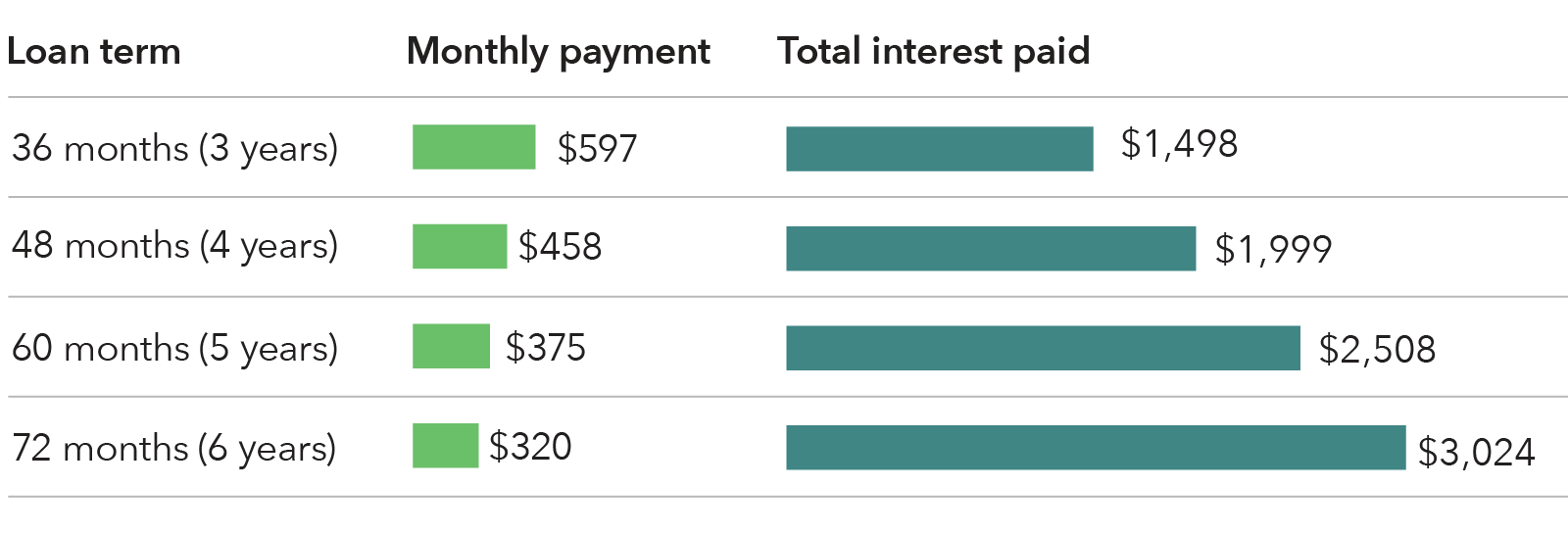

4 Ways To Lower Your Monthly Car Payment Bankrate Com

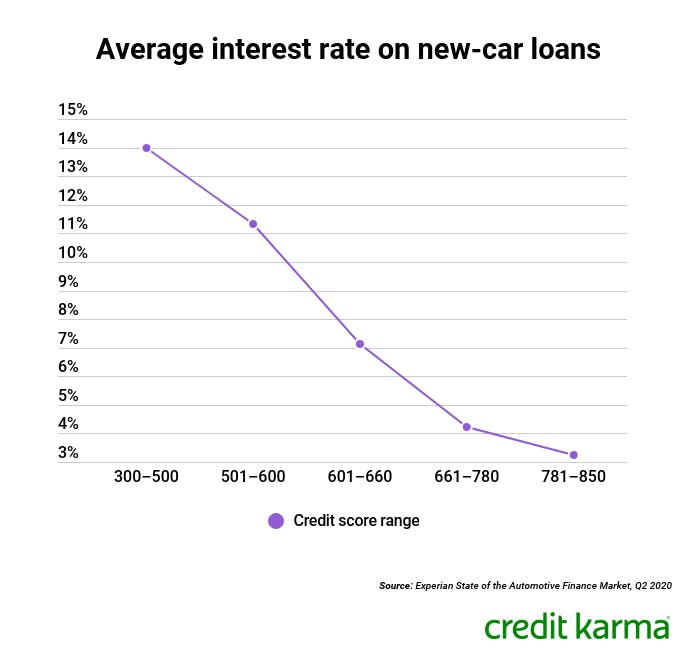

How To Get A Car Loan With Bad Credit Credit Karma

How Do Car Loans Work What You Need To Know Credit Karma

What Minimum Credit Score Do You Need To Buy A Car Nerdwallet

How Does Interest On A Car Loan Work Credit Karma

Auto Loan Calculator Car Payment Tool At Bank Of America

How To Calculate Car Payments Youtube

Is Car Loan Interest Tax Deductible Carsdirect

Is Buying A Car Tax Deductible In 2022

Are Auto Loan Interest Rates And Apr The Same Thing Auto Credit Express

Can I Get A Car Loan With Itin Numbers Fellah Blog

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice